For those of us who have prided ourselves in our knowledge and ability to navigate borrower qualification guidelines the advent of the Qualified Mortgage and Ability to Repay provisions known as Appendix "Q" strike cold fear in our hearts. We distinguish ourselves in our ability to fit a round peg in a square hole, working each nuance, arguing around the edges with underwriters, and find a way to get loans approved that others can't while still giving those borrowers the very best rates. To us, the fact that these guidelines have now - for the first time in mortgage history - been codified into law represents the end of the utility of our long years of study to know every nook and cranny of lending rules. But if we can look at it from another perspective, we can find some advantages to the black and white approach of the regulation.

Consistency

We know too well how one underwriter allows certain elements, and another treats things differently. While we can sometimes take advantage of these discrepancies, when a loan ends up in the wrong hands it can also create disruptions in your pipeline. Remember your battles with the underwriter over what percentage of non-taxable income could be counted, or whether we could accept a borrower who had only been self-employed for a year? Appendix Q removes the ambiguity of these circumstances and allows us to accept applications with less concern over eligibility.

Shortened Learning Curve

As a new loan officer you face the biggest hurdle in learning loan plan specifications for, potentially, hundreds of different investors. In the past, we have shortened this hurdle by saying "learn FHA, Fannie and Freddie and VA, and then learn how the other programs are different." Great! But that was still FOUR completely different sets of guidelines. With appendix Q, a new loan officer must just learn ONE set of guidelines as a starting point to our origination career.

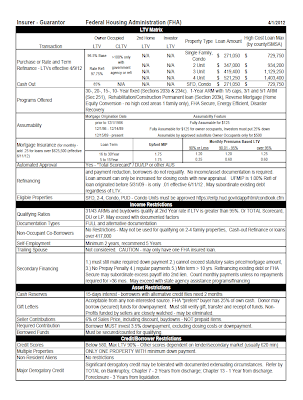

|

| Sample Loan Plan Specification |

Finally, A Practical Continuing Education Application

How many times can we study RESPA, TIL and ECOA in our annual CE? The addition of lending guidelines to the regulatory construct allows us to open the area to discussion in "for credit" education. We study loan guidelines on a daily basis as a matter of course - now lets do it for CE credit!

A Starting Point - FHA

Our lesson, at the highest level starts with understanding FHA lending guidelines, since Appendix Q extracts underwriting guidelines from the HUD-4160.2

As we go through the process of understanding these guidelines more intimately we will try and assemble them into a concise collection of QuickNotes - easy reference tools for us all to compare to. See the FHA Guidelines we have assembled here:

No comments:

Post a Comment