Thursday, April 23, 2020

ADA Website Compliance: Mortgage Lenders the Target

Thursday, March 5, 2020

Where's my Privacy Policy?

Most Important - The first form you should give to a customer

Where's my Privacy Policy?

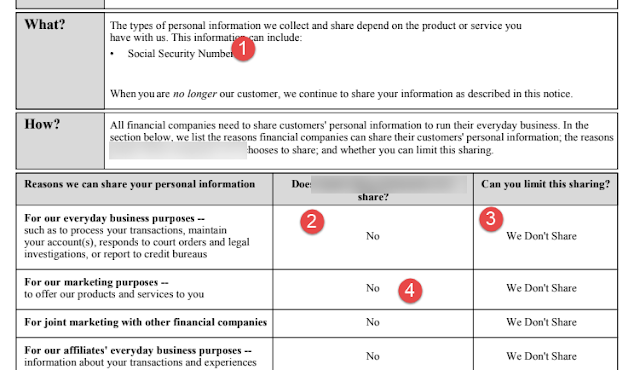

Gramm-Leach-Bliley (GLB) Privacy rules received an inordinate amount of attention in the pre-crisis compliance era. This is due to corporate structures that share consumer information, often without the customer's knowledge. To protect consumers against unauthorized sharing so that affiliates and other firms can market to your consumer, the Opt-Out Provisions of the Gramm-Leach-Bliley privacy rules require that companies tell consumers how they treat consumers' private information. In addition, the company must give the consumer the option to elect NOT to share that information. This results in the form the consumer receives and the instructions they use to opt out.

We still see MANY questions regarding this form and its proper completion, so we have provided this simple guide to correctly populating the form fields.

When a Regulator Asks for your Privacy Policy

We get the question, "where is my Privacy Policy?" in the policies and procedures we provide. It's natural to ask us because of how the question is phrased. But this one does not come in a formulaic narrative manual. It's embodied in your disclosures and (hopefully) on your website. The "Model Privacy Notice" is your "Privacy Policy" as far as GLB is concerned.

How to Correctly Complete the Form

- Add income/employment, asset, credit history, and property information as necessary.

- YES - you send to investors, underwriters, secondary market partners, title companies, etc.

- NO - they can't limit it because they wouldn't get a loan if you didn't share it.

- Depends on your marketing - do you market to your customers - past or present? (e.g., email blasts) If yes, then yes, and your customer must be able to opt out, and you have to have a toll-free number.

Many States Require Specific Disclosures on the Form, Such as Vermont

Not Every Privacy Policy is a GLB Privacy Policy

Tuesday, March 3, 2020

North Carolina Mortgage Licensing and Examinations - What have we learned?

Expect an initial examination within the first 12 months of licensing. Existing licensees who have never been examined should expect one, and this normally coincides with a complaint or other inconsistency.

For those licensed in the state, NCCOB (North Carolina Commissioner of Banks) has clearly and transparently posted its expectations. Yet over and over we see brokers and lenders alike responding with surprise to examination findings and questionnaires. When we review the findings to help licensees comply we aren't surprised, just a little disappointed at what some might call willful blindness.

We have a great deal of respect for the rational approach that the regulator has taken. Nothing in the findings represent anything that brokers or lenders shouldn't be responsible for. If anything, our concern is that these problems exist elsewhere and propagate because of a lack of oversight.

Broker Fee Agreements

It's illegal to collect a fee without the customer's explicit agreement. These files show missing or incorrect broker fee agreements, or incorrectly completed lender financing agreements. The common response or argument is that the LE or CD provides the customer's tacit agreement. However, it's usually too late at that point; the information on the LE/CD should come from the financing or broker agreement.

For our customers, we devote a section of our quality control plan for correct completion and retention of financing or fee agreements.

BSA/Anti-Money Laundering Plans

We sell both stand-alone anti-money laundering plans, or better yet, QC (Quality Control) plans that identify the full set of FinCEN (FINancial Crimes Enforcement Network) identified Red Flags. Our BSA/AML (Bank Secrecy Act/Anti-Money Laundering) plans use these to identify potential SARs (Suspicious Activity Reports) for reporting.

Most people don't read them.

Otherwise, they would know that they include:

- A SAR Reporting Workflow

- A Compliance Officer (You have to put the person's name where it says "Insert Compliance Officer here")

- Initial and Periodic Training (We give this away here, or provide a checklist to ensure you have taken AML specific training as part of your Continuing Education)

- Both FinCEN and Industry Specific Red Flags

Missing Documents in Audit Files

1099's - Beware EVERYONE

We recently wrote an article on 1099 compensation of originators. NCCOB takes the position that originators are employees. Unless you follow the recommendations in our article, expect an issue with 1099 payments. Further, BRANCH MANAGERS ARE EMPLOYEES by definition; you can't be a contract manager. No Branch Manager 1099s. Also, you can't have branches in homes.

Contract Processors and other unlicensed entities

As above, compensating 3rd parties for work normally done by employees, such as processing, should automatically prompt you to require licensing of that individual or service.

Monday, January 27, 2020

Can I pay a Loan Originator by 1099?

Conflicting Interests

https://www.irs.gov/pub/irs-pdf/p1779.pdf

The IRS guidelines basically say, “If you have the right to control or direct not only what is to be done, but also how it is to be done, then your workers are most likely employees.” The IRS focuses on three main areas when determining employment status:

- How much control the employer has over the worker’s behavior and work results. (Who controls training, where and when the person works, what equipment they use?)

- How much control does the employer have on finances? (Does the employer have primary control over the person’s profit or loss?)

- What is the relationship between parties? (Does the worker receive benefits and is it a long-term relationship?)

Here is the 20-point checklist from the IRS, which may be used as guidelines in determining if a worker can be legally paid as a contractor:

- Must the individual take instructions from your management staff regarding when, where, and how work is to be done?

- Does the individual receive training from your company?

- Is the success or continuation of your business somewhat dependent on the type of service provided by the individual?

- Must the individual personally perform the contracted services?

- Have you hired, supervised, or paid individuals to assist the worker in completing the project stated in the contract?

- Is there a continuing relationship between your company and the individual?

- Must the individual work set hours?

- Is the individual required to work full time at your company?

- Is the work performed on company premises?

- Is the individual required to follow a set sequence or routine in the performance of his work?

- Must the individual give you reports regarding his/her work?

- Is the individual paid by the hour, week, or month?

- Do you reimburse the individual for business/travel expenses?

- Do you supply the individual with needed tools or materials?

- Have you made a significant investment in facilities used by the individual to perform services?

- Is the individual free from suffering a loss or realizing a profit based on his work?

- Does the individual only perform services for your company?

- Does the individual limit the availability of his services to the general public?

- Do you have the right to discharge the individual?

- May the individual terminate his services at any time?

Further, fair labor laws stipulate minimum wages, safe working conditions, and benefits.

Draw a Bright Line

There's Only ONE Legitimate Solution

But Everyone's Doing It

Exceptions

- HUD requires that lenders participating in its programs affirmatively eschew conflicts of interest created by outside employment. Lenders offering FHA financing must compensate employees by W-2.

You Cannot EVER Pay a Branch Manager as 1099

SAFE Act Update

- Processing Policies and Procedures

- Information Security

- Fair Lending

- Anti-Money Laundering

- Anti-Predatory Lending