Secondary Market Investors, Regulators Requesting Mortgage Electronic Record System® Quality Assurance Plan

MERS® has been functioning in place for many years, eliminating many cumbersome, expensive and ineffective procedures to effect and track the transfer of individual mortgages in the secondary market. It drew much unwanted attention during the foreclosure crisis, as legal challenges resulting from the inferred opacity of the system - because you can't ascertain the holder of the mortgage/note from county recorders offices - seemed to threaten the very basis of the business model. Having survived, for now, many of the issues which arose during the crisis are now filtering their way to the front lines. Market participants who once did very little more than assign a MERS® ID now find themselves having to fulfill other obligations.

First among these is Quality Assurance. While adding another series of checks and balances to our quality control process seems like another burdensome cost of doing business, a rational approach allows us to understand that we actually conduct this audit as a regular part of our business. We just need to prove we do it. This involves two steps:

1.) Recording our MERS® steps

2.) Having a plan that identifies the person who keeps the records and submits the information

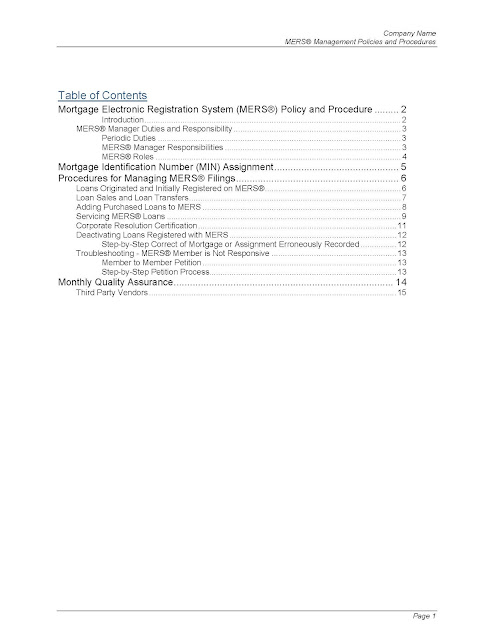

SAMPLE MERS QA PLAN

We have a plan which purchasers of our servicing module receive as part of that, since the process of MERS® management is concentrated in secondary marketing and servicing. Since originating lenders now seem to be responsible for their small portion of MERS® compliance, we are making this policy available to our customers at no charge on our updates and downloads page. Non-customers can purchase the plan for $195.00 on the website here https://www.mortgagemanuals.com/mers-quality-assurance-qa.html.