Checklists are foundational quality control elements and can improve process efficiency and identify problem areas. But bad checklist practices can create more problems than they potentially solve.

If you have spent any time in the industry, you have seen checklists of one fashion or another. In mortgage banking, where there are literally 3,000 quality control checks in a single loan file, it's hard to conceive how any individual - new initiate or seasoned pro - could keep all of the elements in mind while reviewing a loan file. So, naturally, some sort of job aid evolves in every workplace. We need to applaud those who develop these tools because they have so many overlapping beneficial purposes and uses. But while even a bad checklist or form can solve some problems, companies don't realize their full benefits unless they use one designed to capture all purposes and work within the flow of a particular function's duties.

Independence

The insistence on independence in the review process comes from the idea that 1.) you are too close to your own work to review it and 2.) you are pre-disposed to cover up any errors you make, so these preclude you from auditing your own work. However, if honestly adhered to, checklists can create independence. Checklists don't fudge reports, or have a bad day and miss things they ordinarily wouldn't. So you don't have to hire a 3rd party auditor to obtain independence. You just need a good checklist.

Consistency

By using a single checklist across your platform, many of the misunderstandings and inefficiencies get eliminated because everyone works through the same form. No surprises!

Checklist Design Best Practices

In designing a checklist, think about the process or documents you use the checklist to review. Key principles in this process

- You may use the review data again; more than just as a checklist for a processor, for example. You need a format that you can easily break up and re-integrate. Although you can get nicer formatting through Word, you can more easily access and manipulate data in Excel. A worksheet that will be used as a training tool, that contains manual calculations, or handwritten notes for one time use, lends itself to Word formatting. An audit checklist, which you use for extracting missing or erroneous items from a long list, lends itself to Excel formatting, so you can export the information into your LOS or aggregate into reports.

- You can use prompts within the descriptive fields as a decision tree. For example If>then statements, or by identifying specific guideline triggers such as $____ > $, then... This level of detail allows you to aggregate the descriptive information in any report. This is one of those areas where you can get more bang for your buck from the process by understanding the different ways you can use the information garnered through the checklist review.

- Organize the form in a way that a reviewer would rationally progress through the file. For instance, in a cross check of property address, rather than having the reviewer stop and browse through application, contract, W-2 and paystub, appraisal, survey and any other address bearing exhibit, review each exhibit one time, coming back to confirm information. Awkward checklists that make the user bounce around the file or the form don't get used and create more mistakes than errors they solve.

- MAKE SURE BINARY CHOICES ALWAYS ADDRESS THE SAME POSITIVE OR NEGATIVE CONTEXT!! One of the most common faux pas on a checklist is having a yes/no box, but the yes or no have different meanings. This makes the reviewer have to review the entire checklist item again when recording findings. Phrase checklist elements to only flag a check if an item is wrong, or for a no flag to indicate non-compliance. For instance, don't have one question saying "is the earnest money deposit check cleared?" which a yes would be a non-finding; the next question shouldn't be "is there any evidence that the property is not owner occupied?" where no is a non finding.

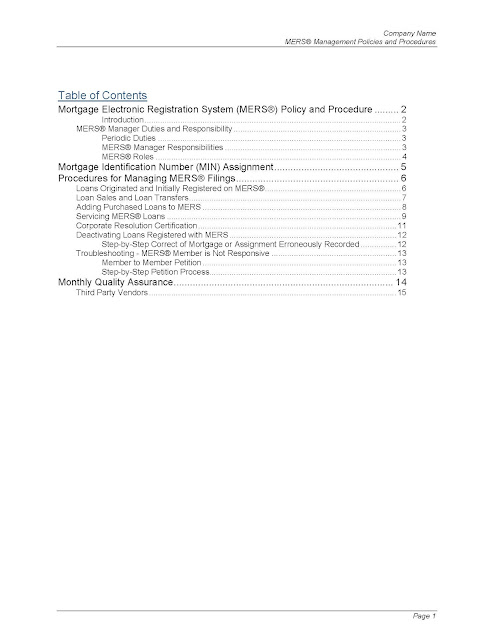

- COMPRESS! While this can be taken to extremes (I have been guilty of this; trying to get it all on ONE PAGE!), do pay some attention to not making forms excessively long. AT A MINIMUM, on a multi-page form, try to insert page breaks when the context or content changes; again, keeping the reviewer from bouncing between pages. (The one at left turns into a 10 page pre-funding review because of white space and inattention to compression.)

- WHITE SPACE can be useful, but having white space simply because of a long descriptor makes for a very long form. This is the kind of thing the government would do.

- Multiple versions of the same checklist. We often see multiple varieties of a single checklist used for different types of loans. This multiplies the likelihood that a checklist won't get updated when there is an across the board change. Most frequently this appears in underwriting checklists, but elsewhere as well, when you have a different checklist for FHA/VA/Jumbo Investor/MI and other specs which vary slightly. In cases where the bulk of the checklist (up to 50% or more) consists of items reviewed on every loan, you shouldn't create separate versions of checklists in this way, but should work to create dropdown lists which highlight the specific investor guidelines.

These Checklists ARE Audits!

For those who want to evaluate their procedures and learn how their businesses could run better, the results of these reviews, properly imported into the LOS or database, show us where we make repetitive errors, where we miss things our partners pick up, and which individuals most effectively perform their functions.

In the end, embrace the idea that you constantly edit your forms and checklists. "Perfect is the enemy of good." We designed our templates with that in mind; you can use them to track changes in your business, investor or wholesaler requirements, and regulatory changes. We have found that it is possible to close a loan without conditions by anticipating every possible requirement. Imagine how much time you would have left to originate new business if you weren't chasing conditions after the fact?