The targeting of audit subjects through the use of the CFPB Complaint Portal means you need a proactive complaint resolution process

Since the Consumer Financial Protection Bureau began accepting complaints related to mortgage transactions in 2011, the industry's fears that this would simply act as a targeting mechanism have been realized. Multiple complaints, more than a single complaint, act as a red flag attracting the worst kind of scrutiny. Recent presentations by CFPB Senior Analyst Ann Thompson confirmed this. As a preventative tool, our first recommendation involves adding a daily or weekly check of state and national complaint portals by the company's compliance manager.

But it goes beyond dealing with complaints. You must take a proactive attitude. Make it easy for your customers to file a complaint with you and company management directly, before the customer elevates it to the regulator to resolve it. This means:

- Adding prominent "complaint" button on web pages

- Proactively sourcing "compliments and complaints" via promotional materials

- Asking customers "have I addressed all of your concerns today?" question in the footer of all electronic communications

In addition, have an effective process for resolving complaints once they arise. This is called a "Complaint Resolution Process"

More importantly, though, all employees need to understand they must participate in communicating to troubleshoot, document and resolve complaints.

If you have our Quality Control and Compliance Modules we provide you with a Complaint Resolution Policy template. It's time to pull it out and make sure you are ready to adhere to it.

Rule # 1

LISTEN! Listen to the customers complaint. Identify what the customer's real problem is and acknowledge that it is a problem. You do not have to admit fault to show empathy.

Rule # 2

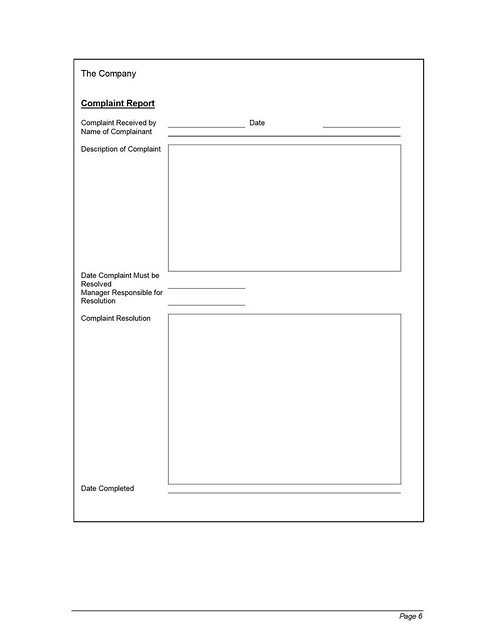

DOCUMENT! Make sure the file has been documented with correspondence and that the conversation log has been populated. Complete a complaint report and deliver it to the manager for review.

Rule # 3

RESOLVE and close the complaint. Based on the manager's determination, diary your Outlook Calendar to follow up with the customer and ascertain that the problem was handled. Not every customer will be happy, but if you are responsive, the customer will not automatically elevate the complaint.

Sample Complaint Resolution Policy - Request a Free One

Complaint Resolution 101

This is a problem solving business, and there is rarely a loan where absolutely everything goes as planned.If you have our Quality Control and Compliance Modules we provide you with a Complaint Resolution Policy template. It's time to pull it out and make sure you are ready to adhere to it.

Rule # 1

LISTEN! Listen to the customers complaint. Identify what the customer's real problem is and acknowledge that it is a problem. You do not have to admit fault to show empathy.

Rule # 2

DOCUMENT! Make sure the file has been documented with correspondence and that the conversation log has been populated. Complete a complaint report and deliver it to the manager for review.

Rule # 3

RESOLVE and close the complaint. Based on the manager's determination, diary your Outlook Calendar to follow up with the customer and ascertain that the problem was handled. Not every customer will be happy, but if you are responsive, the customer will not automatically elevate the complaint.

Sample Complaint Resolution Policy - Request a Free One

No comments:

Post a Comment